For seafarers working far from home, sending extra money to support their families can be a challenge, especially when time is of the essence.

Unlike land-based workers who have easy access to various international remittance services, merchant mariners often face delays, limited options, and high fees.

Traditionally, maritime professionals have relied on four common methods for sending money from abroad, but these methods are slow and can take weeks or even months to complete.

In today’s fast-paced world, waiting that long is no longer practical.

That’s why we’ve gathered 7 reliable and faster alternatives for seafarers to transfer money more efficiently.

Different Methods for Sending Extra Money While On Board

With modern technology, sending extra money from onboard is faster and more convenient than ever.

Seafarers can now transfer funds effortlessly, without relying on traditional methods.

I have used most of these cross-border payment methods and they all worked great.

1. Normal Allotment

Normal allotment is the most common method seafarers use to send remittances home.

Governed by international laws, this structured approach enables seamen to transfer income automatically.

Here’s how it works:

Key Features:

- Convenient, hassle-free transfers

- Compliance with international regulations

- Automatic monthly transfers to nominated bank accounts

- Fixed amount and recipient, determined during contract signing

- Currency conversion (e.g., USD to PHP or EUR, or maintained in USD for dollar accounts)

Considerations:

- No flexibility to alter or change amounts or recipients

- Salary conversion rates may apply (e.g., USD to local currency)

And since a seaman’s salary is given in US Dollars, the amount of money sent to your bank accounts is converted to local currency like Euro, Rubbles, Rupiah, etc.

Or it will still be in dollars if you have a dollar account.

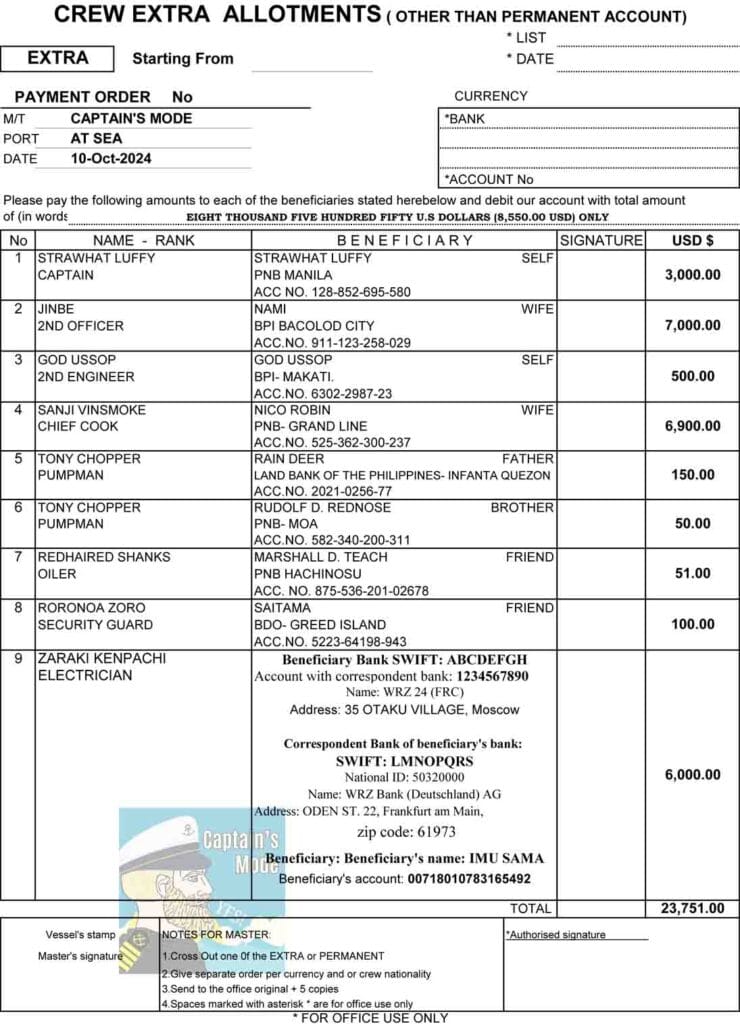

2. Extra Allotments/ MPO

An Extra Allotment, or Master’s Payment Order (MPO), is another way seafarers can send remittances while on board.

Unlike the standard allotment, MPO gives seafarers the flexibility to decide both the recipient and the amount of money they wish to send, provided they have sufficient balance in their wage account.

Key Features:

- Nominate receivers and specify amounts

- Send extra funds from your wage account balance

- Complete a form provided by the captain

- Receive funds in the nominated bank account within days or weeks

Benefits:

- Flexibility in sending extra funds

- Convenient paperwork process

- Suitable for emergency or loan repayments

Considerations:

- Requires sufficient balance in wage account

- Processing times may vary (days to weeks)

Also called Special Allotments, I utilized MPO for remittances and found it convenient on my first ship as a deck cadet.

Some of the crew also used it when borrowing money from each other.

3. Emergency MPO

Emergency Master’s Payment Order (MPO) is a special type of extra allotment that allows seafarers to send money urgently due to unforeseen circumstances.

Unlike regular MPOs, Emergency MPOs require a valid and urgent reason, such as medical emergencies or family crises.

Eligibility:

- Valid emergency reason required

- Captain’s approval necessary

- Limited availability due to additional costs on the company

Processing:

- Priority processing for urgent situations

- Potential extra fees for banks and companies

On the companies’ side, they usually pay heavy fees to the banks when sending our remittances whether its the normal allotment or an MPO.

That’s why they limit these features or only allow the normal allotment.

Examples of Emergency Reasons:

- Families affected by sudden natural catastrophes at home (earthquakes, typhoons, floods, etc.)

- Family member getting seriously ill where savings account is not enough.

- Your wife’s bank account got hacked and all the money was stolen.

- Your allotee’s bank goes bankrupt, unable to withdraw the money.

- The house got burned.

- Other similar reasons

Tuition fees, groceries, and your car’s monthly payments are not emergencies since these are expected every month.

4. Through Off-signers

One traditional way seafarers send extra cash is through an off-signing crew member.

Before leaving the ship, a crew member who is about to sign off often agrees to deliver money to the seafarer’s family, friend, or relative back to the home country.

Key Aspects:

- Trust-based system among crew members

- Offsigner acts as a courier for extra funds

- Receiver options: in-person meeting, bank deposit, or local remittance

While convenient, this method carries significant risks.

Drawbacks:

- Delayed transfers (weeks or months) due to crew change schedules

- Risk of theft, robbery, or loss during offsigner’s travel

- Loss of hard-earned money

- Difficulty in resolving disputes

- Potential for crew mate to abscond with funds

5. Online Bank Transfers

With the rapid advancement of technology, online bank transfers have become a reliable and convenient way for seafarers to send extra money to their families. Many banks now offer mobile banking services, allowing users to transfer money directly to other bank accounts in the Philippines using just a smartphone.

Benefits:

- Accessibility: use internet facilities on ships or purchase internet SIM cards

- Convenience: transfer funds directly to beneficiaries’ bank accounts

- Flexibility: supplement regular allotments or send emergency funds

Tips for Seafarers:

- Check with your bank for online banking availability

- Utilize self-allotment or ask a crew mate with online banking

- Ensure secure transactions with reputable banks and internet connections

For many years, I’ve relied on online banking to manage my finances and support my family.

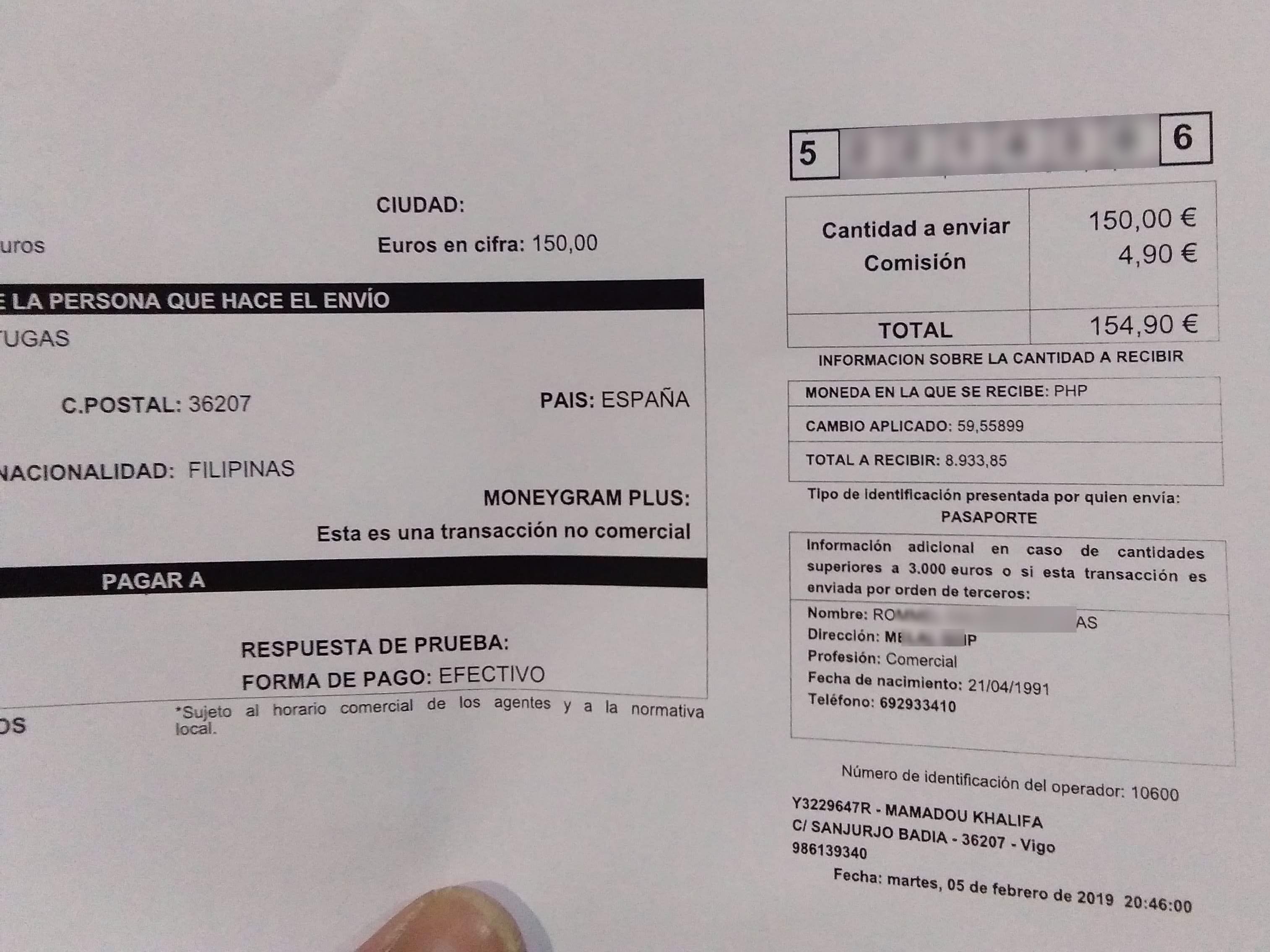

6. Money Transfer Agents

The money transfer industry has grown significantly due to globalization, and it’s a popular option for seafarers who need to send cash to their families without using bank accounts.

Even if you’re sending money from the United States to the Philippines, money transfer agents like Western Union, MoneyGram, and Ria are trusted services that allow quick transfers across borders.

Benefits:

- No bank account required

- Fast, secure transactions

- Competitive fees (e.g., €4.90 for a €150 transfer)

Recent Developments:

Last year, my crewmate sent Euro 350.00 to his family. He spent an additional Euro30.00 for that transaction.

And just over a week ago, I was ashore with my crew mate in Spain.

We went to a remittance center where he sent Euro150.00 to his wife through Moneygram.

Guess how much the fee is?

Euro 4.90.

That’s crazy low!

The transaction fee went really low because most of these remittance centers are partnering with cryptocurrency platforms like Ripple’s XRP.

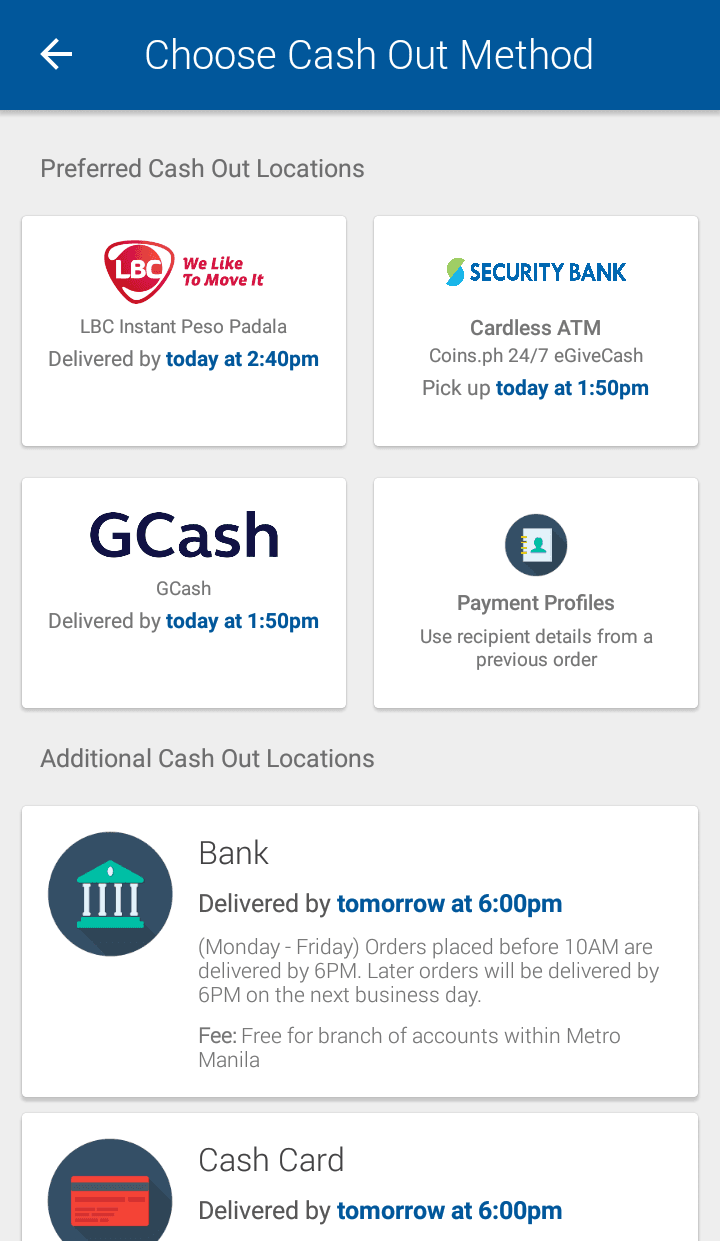

7. Online Non-bank Financial Institutions (NBFIs)

Non-bank financial institutions are companies that handle money transfers and remittances without their clients having to put up a deposit account.

They are widely used in developing countries where the the banking system only penetrates less than 35% of the population.

Examples of NBFIs

- Palawan Pera Padala

- Cebuana Lhuillier

- GCash

- Maya

- Coins.ph

- PayPal

I normally use Coins.ph and GCash for domestic transfers and PayPal for international transactions.

Conclusion: Sending Extra Money Safely

Sending extra money home is crucial for seafarers, yet many are hesitant to use modern financial tools due to security concerns.

They worry that their funds could be hacked or lost in cyberspace, never to be recovered.

I understand this sentiment; I once shared these fears.

However, I believe the benefits of using digital money transfer methods far outweigh the risks.

In contrast, relying on traditional banking methods can sometimes pose greater risks.

Encountering an armed thief while carrying large amounts of cash could lead to a traumatic experience for you or your loved ones.

Ultimately, adopting secure and efficient money transfer methods can help ensure that your hard-earned cash reaches your family safely and quickly.

May the winds always be in your favor

Leave a Reply